does georgia have an inheritance tax

In 2014 the Georgia estate tax was eliminated you no longer have to pay an estate tax in Georgia for deaths before 2005. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

No Georgia does not have an estate tax or an inheritance tax on its inheritance laws.

. Any deaths after July 1 2014 fall. Only 11 states do have one enacted. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

Elimination of estate taxes and returns. Nevertheless you may have to pay the estate tax levied by the federal government. Most state residents do not need to worry about a state estate or inheritance tax.

A federal estate tax is in effect as of 2021 but the exemption is. However this privilege only applies to. Estate taxes also called inheritance taxes are the taxes paid on the assets left to the family of a deceased person.

Does Inheritance or Estate Tax Apply in Georgia. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance.

Does Georgia Have an Inheritance Tax. For 2020 the estate tax exemption is set at 1158 million for. Does Georgia Have an Inheritance Tax.

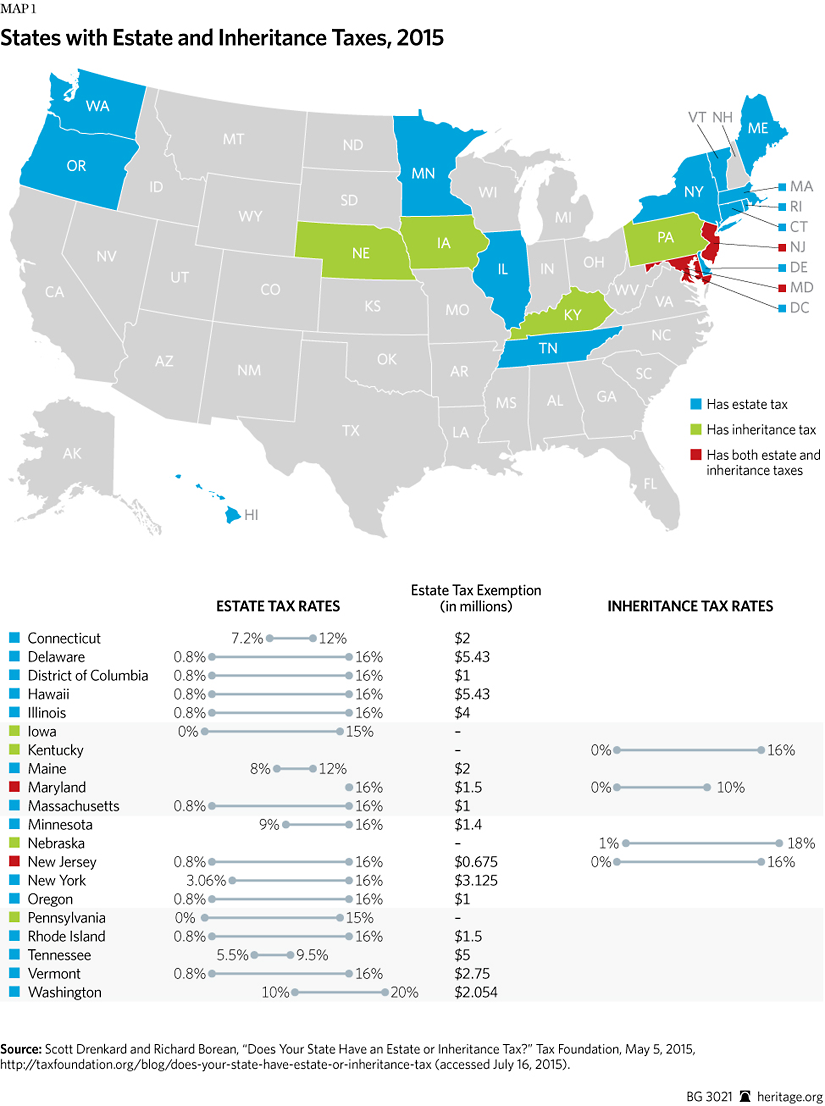

48-12-1 was added to read as follows. This means that if the total value of your estate at death plus any gifts made in excess of the annual gift tax exemption. State inheritance tax rates range from 1 up to 16.

But some states do have these kinds of taxes which are levied on people who. As a result only very wealthy people currently need. Estate Tax - FAQ.

As of July 2014 estates in Georgia no longer have to file estate tax returns or pay estate taxes. No Georgia does not have an inheritance tax. Also called a death tax the estate tax is the final round of taxes someone pays before their property is distributed to their heirs.

Inheritance taxes are applied to a persons heirs after they have already received money from someone who recently died. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount. Inheritances that fall below these exemption amounts arent subject to the tax.

The estate tax is different from the inheritance tax. Georgia estate tax and georgia inheritance tax the state of georgia eliminated its estate tax effective july 1 2014 and has no inheritance tax. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206.

States Without Death Taxes. For 2017 the Federal Estate and Gift Tax Rate is 40. As of July 1 2014 Georgia does not have an estate tax either.

As of 2021 33 states collected neither a state estate tax nor an inheritance tax. As of July 1st 2014 OCGA. Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person.

The federal Estate tax seizes a portion of. Seventeen states have estate taxes but Georgia is not one of those either. Provisions of OCGA.

Does Georgia have an estate tax. The federal gift and estate tax exclusion is currently very high1158 million for an individual and 2316 million for a married couple in 2020. Georgia has no inheritance tax.

Any deaths after July 1 2014 fall under these rules. Still this will impact only a small percentage of Estates in Georgia. There is no federal inheritance tax but there is a federal estate tax.

As of 2014 Georgia does not have an estate tax either. This applies to every Probate proceeding that occurs everywhere in the country. You may still have to file a gift tax return.

What You Need To Know About Georgia Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

401 K Inheritance Tax Rules Estate Planning

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax In The Uk Offshore Citizen

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

State Estate And Inheritance Taxes Itep

Is Your Inheritance Considered Taxable Income H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax Advice For Expats And Non Uk Residents Experts For Expats

State Death Tax Is A Killer The Heritage Foundation